Article by React News, written by

Guy Montague-Jones, Analysis Editor

When Panattoni first entered the UK market with the purchase of First Industrial in 2017, the company’s focus on speculative development raised a few eyebrows.

Would it put rents under pressure by flooding the market with new stock? Five years on, the answer to that question is a resounding no. Panattoni has rapidly established itself as a leading force in the market, reaping the rewards from the UK’s logistics boom, at the same time as continuing to grow its presence on the continent.

Despite its growing scale, Panattoni has remained largely in the shadows, rarely speaking out in the press, giving little away on its financial model and strategic direction. In a rare interview,

Nick Cripps, head of capital markets, UK, breaks this silence, giving the lowdown on Panattoni’s funding model, its approach to managing risk and future plans.

I joined Panattoni to head the capital markets team in the UK and also as a European director with responsibilities for managing our capital partners from across the globe who have investment strategies in Europe.

My role is made up of two key parts. Firstly, I am charged with facilitating our international investor relationships and those mandates that are actively deploying across Europe. Within this I am responsible for ensuring an efficient execution process through the transaction management of multiple projects across our platform. I work very closely with my colleagues across our international network, especially those in Europe, as the majority of our investors adopt pan-European or even global strategies. Since joining, I have been amazed by the scale of Panattoni, the market and technical expertise, and the incredible depth of our occupier and capital relationships.

The second responsibility I have is to assist in the formation of new investment strategies and the origination of new capital relationships. As a 35-year-old business with a US heritage, we have a large number of established joint venture partnerships; however, we actively seek to form new partnerships, especially where it will help us expand our platform.

Panattoni’s model allows us to cater for core, core-plus and value-add investment strategies and we pride ourselves on being the largest provider of direct investment opportunities internationally for industrial and logistics.

How does the UK fit in with your continental European business? You’ve focused a lot on the larger end of the market in the UK in recent years, but do you expect to shift the focus more towards the continent in future?

The UK forms an integral part of our global platform, not just European.

In Europe, we are active with a diverse range of investment strategies, most of which are cross-border and operate in harmony with occupier supply chains, of which the UK is an essential component.

Since Panattoni’s arrival in the UK, we have focused on larger lot sizes, where we have high conviction and still believe the market dynamics to be very favourable. This certainly doesn’t prohibit us from looking at the smaller end of the market or indeed other industrial sub-sectors away from e-commerce and logistics. However, at the moment this is where we have been seeing the volume.

If you are looking to build a truly diversified logistics platform or portfolio, you need to understand the make-up of international supply chains. You can’t approach pan-European logistics adopting an office or retail investment philosophy and simply focus on the key gateway cities. European logistics is all about products or goods moving along the supply chain, and that means you have to view Europe as one territory. As far as the occupiers are concerned, the continent is borderless. There’s no friction when it comes to the movement of goods across countries, which means a variety of dynamics are at play when it comes to occupiers deciding on where they want to be located. Ultimately, our objective is to be where the occupiers want to be, so understanding these dynamics is critical.

Can you reveal a bit more about Panattoni’s funding model and how the business has been able to grow so quickly, particularly in the UK?

We have access to multiple pools of capital through a series of mandates and joint venture partnerships. A number of these are deep-rooted capital relationships with large investors in the US, Canada, Asia and Europe, most of whom are seeking scale and breadth across the continent, all of which we can provide.

The benefit of our platform is that it gives us a global perspective, which is fundamental to our operation as it helps us identify emerging trends in both the capital and occupier markets. It gives us visibility across these markets, allowing us to adapt to a diverse set of geographical markets, dependent on local trends and dynamics. Where the occupiers want to be, the capital follows, and having this flexibility in our structure allows us to allocate capital into the markets where we see the greatest occupational demand.

In 2017, Panattoni spotted an opportunity in the UK logistics market and merged with First Industrial, an established developer, which allowed us to expand our footprint here and become the largest speculative developer in the UK. By doing this we positioned ourselves to capitalise on the rapid growth in occupier and investor demand for logistics space.

We have maintained our position as Europe’s largest developer for the last five years. This has given us the foundation to continue our expansion into new markets, which remains a key objective of ours.

Panattoni is best known for the size of its speculative development programme. How do you manage the risk involved and do you have any concerns about how the business would fare if the market were to cool?

The motivation to develop speculatively, and at scale, in the UK, was frequently questioned; however, the rationale is very simple – it is found in occupational activity. The convenience and reliability of logistics with the efficiency of its delivery channels continues to drive demand – principally through e-commerce and omni-channel retailing. The UK is one of the most sophisticated and prolific online economies in the world and our on-demand society has got itself hooked on instant gratification. Waiting for a build-to-suit project is simply not feasible for many occupiers operating in the extremely fast-paced and competitive e-commerce arena.

When Panattoni entered the UK in 2017, build-to-suit activity represented around 75% of the new build market, with speculative development making up the balance. This was almost the exact inverse to what we were experiencing in the US, which for us highlighted that the market was set for change. The UK market is now much more equal, with a broadly 50:50 split between speculative and build-to-suit, and we anticipate this trend continuing to shift towards a more US approach to development which favours speculative projects.

Today, we are seeing identical trends play out across Europe with customers needing immediate space as they rationalise and expand their supply chains, and we are responding to this – we currently have 32 million sq ft under construction across Europe alone.

Our corporate structure means we have the flexibility to adapt and respond to the ever-evolving occupier needs. Panattoni is a mature business with far-reaching expertise – we cover everything within the industrial universe, be it manufacturing, light industrial, data centres, cold storage or assembly plants, in addition to e-commerce and logistics.

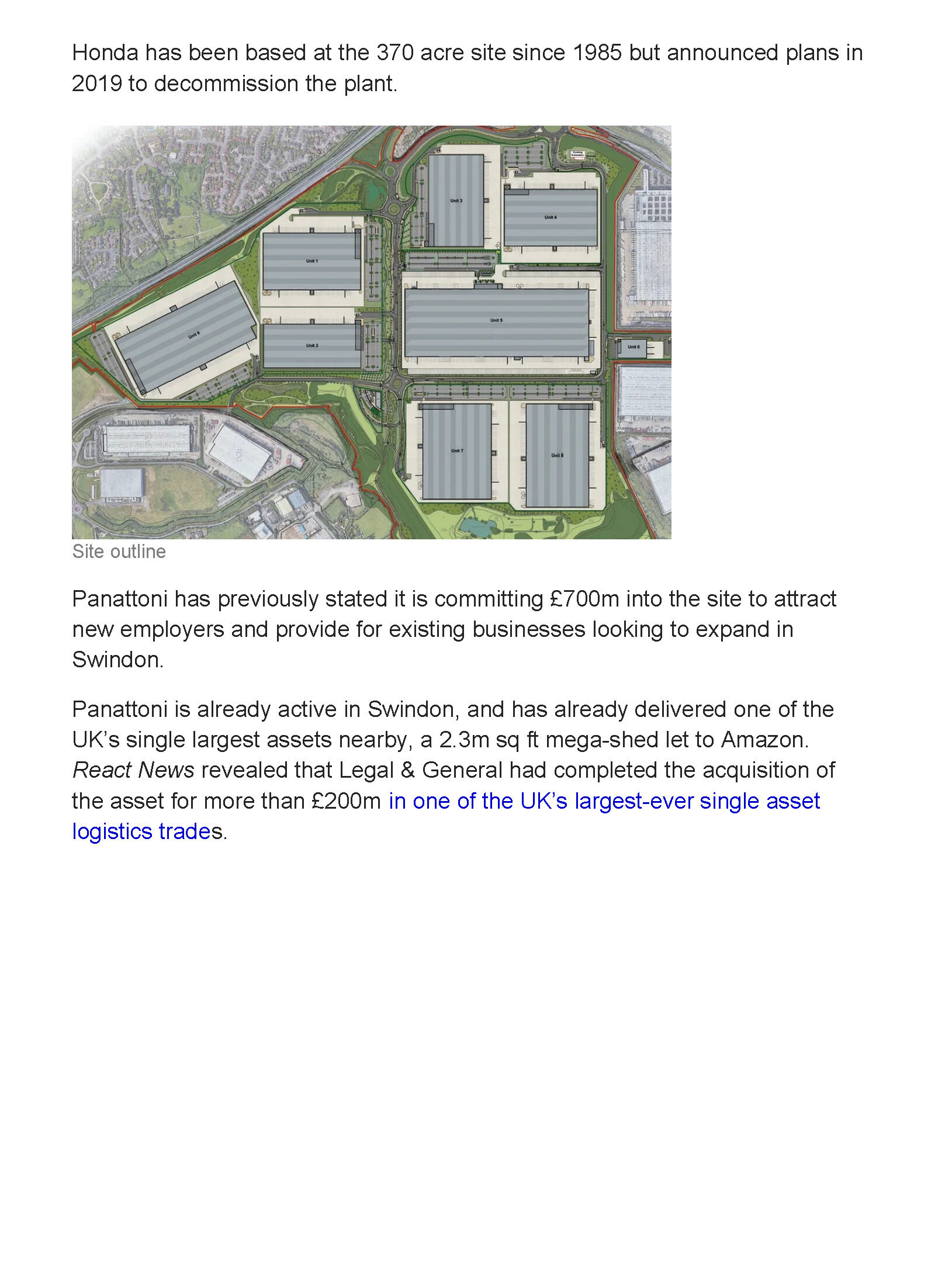

How does this work on an individual scheme level, particularly for large projects like the Honda plant in Swindon where you plan to invest £700m?

We are one of a small handful of developers that can operate at this scale and deliver a site of this size and complexity. Given the various stakeholders involved and the various local and national sensitivities, confidence in our deliverability was paramount. With an extensive network of capital relationships looking for sizeable commitments such as this, we were quickly able

to secure and finance this project on behalf of one of our long-standing joint venture partnerships.

Panattoni plans to invest £700m in one of its largest logistics schemes to date after buying the former Honda plant in Swindon

How did you approach 2020’s landmark £200m sale of the Amazon warehouse near Swindon?

This is an example of reacting to an opportunity to maximise investor returns by recapitalising a project with a much lower cost of capital through a forward-funding structure. Because of our model, we were able to decisively adjust our exit strategy based on the specific merits of the situation.

We had originally intended to deliver the site through a speculative build programme, but were subsequently approached by Amazon, which wanted to partner with us to develop the whole site for its sole occupation. We are one of Amazon’s largest delivery partners globally, and before agreeing the deal with the company at Swindon, we had just completed delivering the largest Amazon facility in Poland – in Gwilice – which is a four-storey, 2.1m sq ft facility. We currently have more than 70 active projects with Amazon in the US alone.

At Swindon, we were able to quickly meet Amazon’s delivery requirements for what was the largest single-asset logistics letting and forward funding deal ever negotiated in the UK.

Are we likely to see more sales in the UK as your projects progress? With investor demand so strong, are portfolio sales likely to be on the cards for Panattoni?

Nothing is off the cards. We recently disposed of our second unit at Panattoni Park Luton. Following the letting of the warehouse to Ocado on a 20-year term, it felt an opportune time to capitalise on the insatiable demand for logistics opportunities in close proximity to London. This traded in November 2021 at a record low net initial yield of 3.00% for this income profile outside London. At the moment, however, our primary objective is to build our project pipeline and delivery across the UK and Europe, so we can continue to meet the burgeoning occupier demand.

Over the last 18 months logistics has found itself at the top of the shopping list for our investors, not only because of its compelling growth story, but also due to the uncertainties surrounding other mainstream real estate sectors. Many investors are trying to rebalance their portfolios, reweighting their sector allocations in favour of industrial. The logistics sector was already feeling the beneficial tailwinds of e-commerce prior to the pandemic. However, the response to COVID by all property participants has been unequivocal, with a number of other dynamics coming to light in response to COVID that are further increasing occupational activity.

When it comes to selling assets, we don’t always have a fixed agenda and we are constantly working on a number of strategies simultaneously. Our approach to exit depends entirely on the business plan for an individual project, but, as with Amazon Swindon, we remain flexible with a focus on maximising investor returns. Whether we decide to sell on or off market will generally be dictated by the overall merits of the situation and the market dynamics at the time. Adopting either approach might also be accretive to a wider strategy of ours at that point in time.

Legal & General forward purchased Panattoni’s £200m+ Amazon-let warehouse near Swindon in 2020

Given that the outlook for the occupier market is so positive, is Panattoni planning to recycle capital more aggressively in order to put more money to work in new developments?

We’re focused on increasing our development programme and we have no need to recycle capital in order to expand the pipeline. The biggest challenge we have currently is finding good quality deliverable sites that allow us to react quickly to occupational demand. We’re currently working on a very exciting pipeline of opportunities but we’re a hungry beast and constantly on the lookout to expand our footprint, especially here in the UK.

How do you see Panattoni evolving over time? For example, with the launch of your own funds?

We’re a very ambitious business and are always looking at ways in which we can grow, however we are committed to remaining a pure play traditional developer-trader.

In our 35-year history we have focused on providing direct investment opportunities for investors, not creating funds for indirect investment which could compete with our investor base or restrict our ability to grow.

We have worked hard to build up a diverse range of capital relationships in the US, Canada, Europe and Asia, with a broad range of investor types, and this business model continues to be one of our USPs.

panattoelement

on

May 18, 2022