Panattoni is the largest logistics developer in Europe for the 4th year in a row

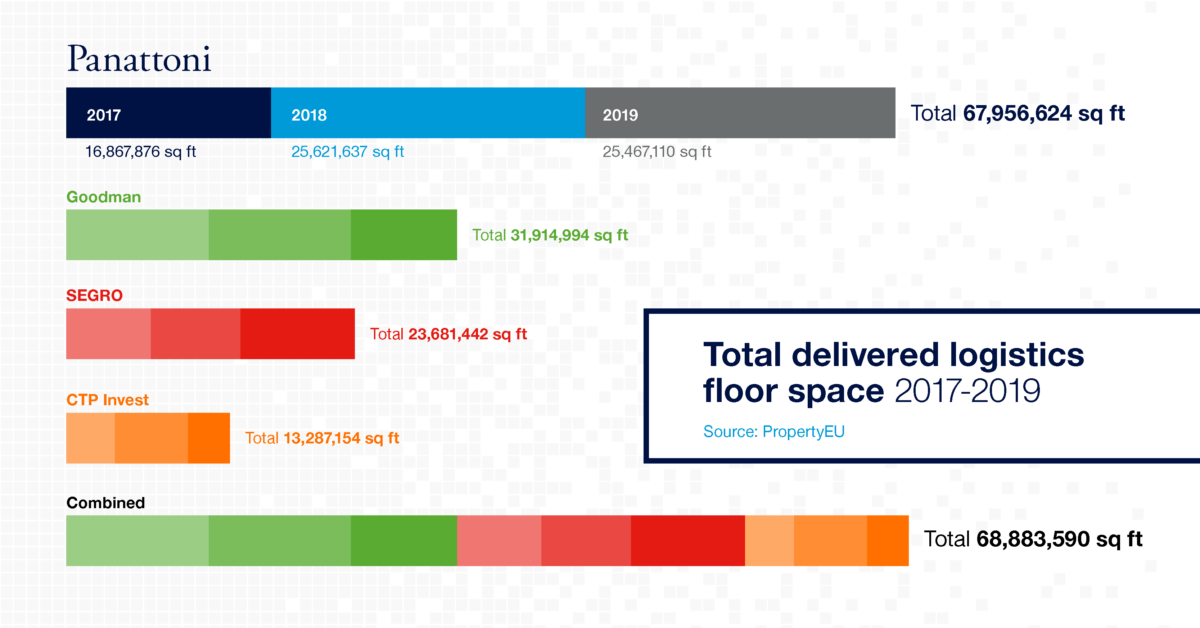

It’s the fourth year in a row when Panattoni ranks first among the Top Logistics Developers by PropertyEU magazine. Between 2017-2019, the company delivered 67,956,624 sq ft of industrial floor space – more than twice as much as number two in the ranking. Panattoni’s plans for the upcoming three years are even more ambitious, and that will be possible thanks to the acceleration of projects targeted at Internet sales, as well as the ongoing strategy of the developer’s expansion in Europe.

Panattoni firmly ahead of the competition. The European branch of Panattoni Development Company listed as the Top Logistics Developer by PropertyEU magazine for the fourth time in a row! Each year, PropertyEU magazine publishes a list of 10 largest property developers, based on the volume of floor space delivered to the market. 14 developers took part in this year’s ranking, and it covered the period 2017-2019. Panattoni has been acknowledged as the largest property developer in Europe with delivery of over 67.9 million sq ft of completed floor space in Poland, Czechia, Germany and the UK, more than twice overtaking the second player in the ranking. Similarly as in the last year, one-third of the property developments are projects targeted at and selected by the e-commerce sector, and one-fourth represent highly advanced manufacturing facilities.

And even more will come. For the years 2020 – 2021, Panattoni intends to break its own record by multiplying the floor space delivered in the last three years. As commented Robert Dobrzycki, Chief Executive Officer Europe, Panattoni: “They will be driven by online commerce projects in Poland, Czechia, Slovakia, Germany and the United Kingdom, as well as in two new markets opened in the last six months – the Netherlands and Spain, in which we have just announced work on the first investment – Panattoni Park Madrid East” and he also says: “In order to execute the plans, as well as to take advantage of the unprecedented growth in online sales, Panattoni is expanding its team that will focus on e-commerce across all Europe”.

To read the full report, click here.